Non-fungible tokens (NFTs) has played an important role in recent years, mostly getting most of its PR via high market demand. Unlike traditional crypto assets, these blockchain-secured tokens called NFTs stand out due to their non-fungibility, a characteristic that denotes uniqueness. Such distinctiveness means that, unlike typical assets, one NFT cannot be easily exchanged for another, cementing their exclusivity and, oftentimes, their hefty price tags. Yet, as demand burgeons, the realm of NFTs is seeing another layer of innovation—fractional ownership, which, as of this article, boasts a market cap exceeding $200 million.

In this article, we will cover:

- The fundamental nature and significance of NFTs and fungibility.

- An in-depth look into the world of Fractional NFTs.

- How Fractional NFTs operate and the underlying technology enabling their existence.

- The benefits tied to fractionalizing NFTs.

- A step-by-step guide tailored for developers aiming to venture into fractional NFT projects.

- Potential risks and considerations associated with Fractional NFTs.

- Recommendations on where to acquire Fractional NFTs.

What is an NFT?

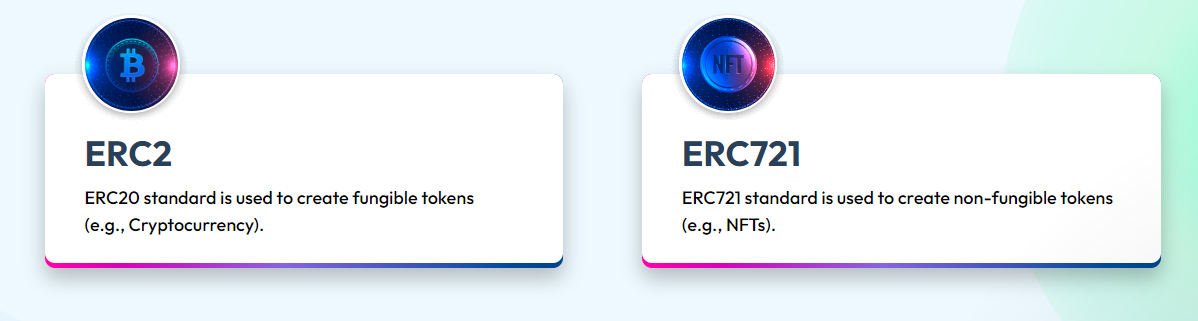

Before delving into fractional NFTs, it’s essential to understand the foundation. An NFT, represented by the ERC-721 standard on the Ethereum blockchain, is a unique digital asset verified using blockchain technology. Unlike cryptocurrencies such as Bitcoin or Ethereum, which are fungible and can be exchanged on a one-to-one basis, NFTs are non-fungible. This means that each NFT has distinct information or attributes that make it unique and irreplaceable, hence deriving its value.

The Rise of Fractional NFTs

The exclusivity and rarity of NFTs have led to sky-high valuations for some tokens, often reaching millions of dollars. While this creates immense value, it also limits the accessibility of such assets to a select few. Enter the world of fractional NFTs, which aims to democratize ownership by allowing multiple individuals to own a piece of a single high-value NFT.

Fractional NFTs represent a concept where ownership of a single NFT is distributed and tokenized among multiple stakeholders. By segmenting the ownership of a high-value NFT into more manageable fractions, it enables a broader range of individuals to partake in its ownership without bearing the full cost.

High-value NFT assets can be too expensive for one individual to acquire, such as a luxury yacht or piece of real estate. Fractional NFTs have a significant impact on this. It enables individuals to make a small investment to acquire a small portion of a costly asset.

(Image Source: pixelplex)

How Do Fractional NFTs Work?

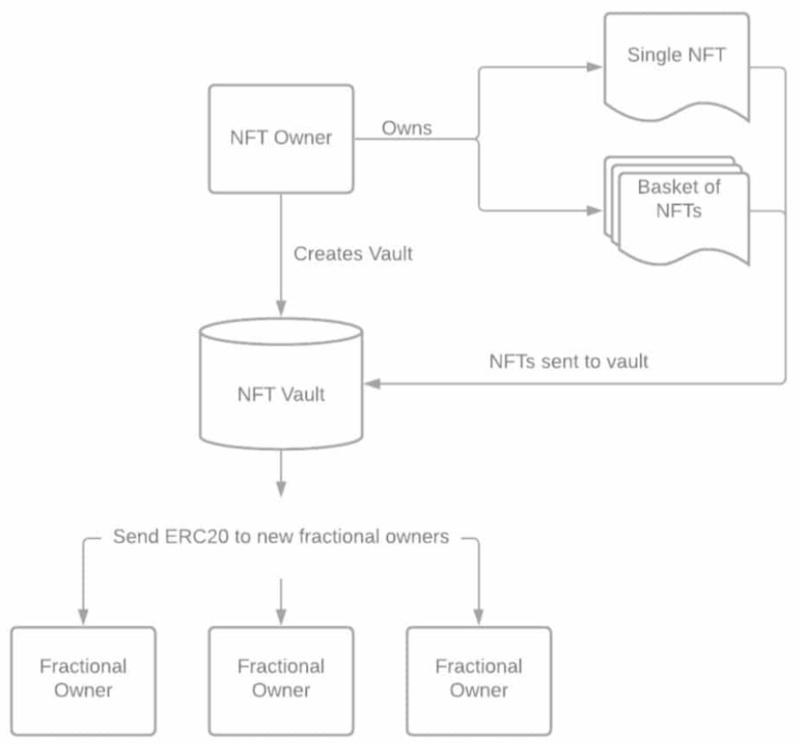

Fractional ownership in the NFT realm is facilitated through a smart contract mechanism. An NFT owner can split their ERC-721 token, representing the NFT, into multiple ERC-20 tokens using a specific smart contract. These ERC-20 tokens are fungible, and each represents a fraction of the original NFT. Essentially, owning one of these ERC-20 tokens equates to holding a percentage of the parent NFT.

(Image Source: mesha club)

For example, imagine an art piece represented as an NFT. This art piece can be fractionalized into 1,000 ERC-20 tokens, and each token would represent 0.1% ownership of the art.

Benefits of Fractionalizing NFTs

Better Liquidity: High-value NFTs can remain unsold for extended periods due to their exorbitant prices. Fractionalizing them makes them more accessible to potential buyers, thereby increasing their liquidity in the market.

Price Discovery: By fractionalizing an NFT and selling a portion of it, owners can quickly gauge the market’s asset valuation. It provides a practical understanding of an NFT’s worth without selling the entire asset.

Curator Fees: The original NFT owner can earn additional revenue by charging curator fees. These fees, often annual, can be set by the owner, though they may be capped to prevent excessive charges.

Easy Monetization: Through fractional ownership, NFT holders can generate income by selling parts of their assets, providing a way to capitalize on their holdings without parting with the entire asset.

How to Launch a Fractional NFT Project: A Developer’s Guide

With the surging popularity of NFTs and the growing interest in fractional ownership, launching a fractional NFT project is an exciting frontier for developers in the crypto world. Here’s a comprehensive guide to help you embark on this journey.

Here is a step-by-step guide on building a Fractional NFT.

- An originator creates an NFT using the ERC-721 standard and secures it within a dedicated vault or smart contract.

- The originator determines the number of divisions for the NFT, setting its value and accompanying details.

- Through the smart contract, the original ERC-721 NFT is split into distinct ERC-20 token units.

- These ERC-20 tokens act as shares of the parent ERC-721 NFT, allowing the originator to market them at a predetermined rate. Prospective buyers acquire these fractional NFTs (F-NFTs) and have the freedom to trade them on tertiary platforms, all while maintaining the intrinsic value of the primary.

(Source: Coin gecko)

1. Conceptualize Your Project

- Define the Objective: Understand the goal of your fractional NFT project. Are you aiming to provide fractional ownership of digital art, collectibles, or something else?

- Target Audience: Define your ideal user. Are they avid art collectors, gamers, or general crypto enthusiasts?

2. Choose the Right Blockchain Platform

Ethereum is currently the most popular platform for NFTs, but others like Binance Smart Chain, Flow, or Tezos might be suitable depending on your project’s needs.

3. Understand the Standards: ERC-721 & ERC-20

- ERC-721: This standard is used to mint non-fungible tokens.

- ERC-20: This fungible token standard will represent the fractionalized parts of your NFT.

4. Develop the Smart Contracts

- NFT Smart Contract: This contract will manage the NFT creation, ownership details, and other unique asset attributes.

- Fractional Ownership Smart Contract: This will manage the process of breaking the NFT into fractional ERC-20 tokens, including:

- Defining total fractions available.

- Minting ERC-20 tokens representing fractional ownership.

- Managing transfer, trade, and ownership of these fractional tokens.

- Implementing a mechanism for recombining fractions to retrieve the original NFT if needed.

5. Integrate Royalty Features (Optional)

For art projects, consider integrating a royalty system so that original creators get a percentage of sales every time the fractionalized tokens are sold.

6. Design a User-Friendly Frontend

Develop an intuitive and secure platform interface:

- User Wallets: Allow users to connect their crypto wallets to interact with the platform.

- Listing & Browsing: Provide functionalities for users to list their NFTs for fractionalization and for potential buyers to browse available fractional tokens.

- Transaction History: Implement a feature to track all fractional token purchases, sales, and trades.

7. Test Thoroughly

Smart Contract Audits: Ensure that your smart contracts are secure and free of vulnerabilities by getting them audited by professionals.User Testing: Engage a group of users to test the platform’s usability and fix any bugs or issues they identify.

8. Launch & Marketing

- Soft Launch: Consider a beta version initially to gather feedback and make necessary adjustments.

- Promotion: Leverage social media, crypto forums, and influencer partnerships to generate buzz about your platform.

- Engage the Community: Keep the community engaged by being active on platforms like Discord or Telegram. Listen to feedback and be ready to iterate based on user needs.

9. Post-Launch Management

- Regular Updates: Technology and user preferences evolve. Ensure you’re regularly updating the platform to accommodate new features or changes in blockchain technology.

- Customer Support: Provide robust customer support to assist users with any queries or issues.

- Continuous Engagement: Engage the community with regular updates, possible future plans, and get feedback to refine and expand your offerings.

10. Compliance & Regulations

Stay updated with the evolving legal landscape around NFTs. Ensure that your platform complies with local and international laws, especially when dealing with real-world assets.

Launching a fractional NFT project can be a challenging yet rewarding endeavor. By focusing on a combination of robust technology and user-centric design, developers can pave the way for the next big innovation in the world of NFTs. Always remember to stay updated, be adaptable, and keep the interests of your user community at the forefront.

Risks and Considerations

Like any financial innovation, fractional NFTs come with their set of risks. The primary concern is around governance and decision-making for the underlying NFT. With multiple owners, decisions such as selling the NFT or using it in particular ways might require consensus, complicating asset management.Fractional Ownership marketplaces might adopt fractional ownership models, enabling shared ownership of high-value NFTs. NFT marketplaces could integrate with virtual reality and metaverse platforms, offering immersive experiences for NFT enthusiasts.

Moreover, the value of fractional NFTs is intrinsically tied to the value of the parent NFT. Any depreciation in the value of the NFT will directly affect the worth of the fractional tokens.

Where to Buy Fractional NFTs?

As fractional NFTs become more established, numerous platforms and marketplaces have emerged to cater to the demand for these unique digital assets. While there are multiple options, choosing reputable, secure, and user-friendly platforms is essential. Below are some pointers and suggestions on where you can buy fractional NFTs.

Top Marketplaces for Fractional NFTs:

Fractional.art: Fractional arts stands as a leading decentralized NFT marketplace dedicated to the fractionalization and trading of NFTs. The platform operates autonomously, driven by smart contracts, ensuring open access for all, free from centralized control. To bolster trust, reputable entities like PeckShield and Harchi Audit have audited its protocol. Notable collections, including Etherrock and CryptoPunks, have contracts on Fractional.art. Through its unique NFT basket feature, artists can break down entire NFT collections, while the platform safeguards against unexpected NFT withdrawals by allowing F-NFT releases only when all tokens are acquired or a buyout occurs.

LIQNFT: LIQNFT presents itself as the pioneering community-driven marketplace for fractionalizing and serializing NFTs within the Solana network. Through serialization, one can claim complete authority over a restricted edition NFT, akin to owning a unique item from a limited series. Imagine a car brand that releases just 100 vehicles, each labeled with its distinct serial number. By embedding your NFT in a serialization-centric smart contract, you can dictate specifications like the quantity of prints, the cost of ownership, and beyond.

Nftfy: Nftfy touts itself as the convergence point for NFT aficionados and unique opportunities. On this platform, users can collaboratively invest in NFTs, purchase fractional NFTs, or even divide their own NFTs into parts. Each offering is decentralized, safeguarded, and housed within a secure vault. To retrieve your whole NFT, you can either pay its set reserve price or its cumulative value. Furthermore, prior to any fractional NFT sales, you retain the ability to revise or withdraw your listing.

NFTX: This platform is a community-driven protocol that allows for the creation and trading of ERC-20 tokens backed by NFTs. Essentially, they pool NFTs to create an index, and you can buy a token representing a share in that index.

Uniswap: While Uniswap is primarily an automated liquidity protocol for ERC-20 token trading, it’s become a hub for trading fractional NFT shares. With its decentralized nature, anyone can list their fractional NFTs for trading.

Foundation: This is a creative platform for digital artists and collectors. While it primarily handles direct NFT sales, it’s also delving into the world of fractional ownership.

OpenSea: As one of the largest NFT marketplaces, OpenSea is continually adapting to the evolving landscape. They’ve begun supporting fractional NFT trades, making it easier for users to buy and sell shares of NFTs.

CurioInvest: This platform allows users to invest in collectible cars via fractional ownership. While not strictly for traditional digital NFTs, it represents a real-world application of the fractional ownership concept using blockchain technology.

Before committing to any platform, always do your due diligence. Check for reviews, ensure the platform uses secure smart contracts, and perhaps start with a smaller investment to understand the process.

Conclusion

Fractional NFTs, operating on the Ethereum standards ERC-721 for unique assets and ERC-20 for their fractionalized counterparts, are pioneering the democratization of high-value NFT ownership by allowing shared stakeholding. Developers venturing into this sphere should emphasize both user-centric design and solid technological frameworks.

However, prospective investors should be cognizant of the complexities related to governance and consensus decision-making inherent to shared ownership. As this innovation progresses, platforms such as NFTX and OpenSea stand out as frontrunners in offering fractional NFTs. Engaging with these platforms necessitates thorough research and due diligence to guarantee a secure and well-informed interaction.